Two of Canada’s massive public pension funds are blasting a plan by Magna International Inc. to simplify its share structure and pay the Stronach family US$863-million.

Both Canada Pension Plan Investment Board and the Ontario Teachers’ Pension Plan are expressing outrage at the compensation arrangement and are hoping to drawn a line in the corporate sand as a warning to other companies that might be considering similar manoeuvres.

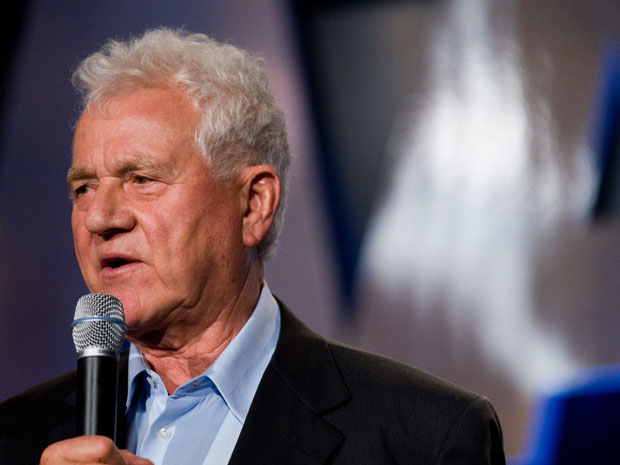

While public pension plans have long opposed the dual class share structures which are considered detrimental to capital markets, “we believe that the premium being paid in this transaction is totally unreasonable,” said David Denison, president and chief executive of CPPIB, in a statement to the press.

That sentiment was echoed by Teachers, which also has made its disapproval public.

“We were shocked and outraged,” said Wayne Kozun, senior vice-president of public equities for Teachers’. Mr. Kozun said the deal was unprecedented both in size and in the manner in which the board has refused to make a recommendation to its shareholders.

Teachers’ owns one symbolic share of Magna in order to exercise their vote. “Owning just one share, we don’t stand to lose money, but we are worried that it will set a precedent in Canada,” he added. Mr. Kozun is hoping that by publishing their position and the rationale behind it, other investors will be swayed to vote against the deal.

“It’s turning into bit of a showdown,” said Richard LeBlanc, associate professor of corporate governance and ethics at York University in Toronto, “Magna is an incredible success story, and there has been wide latitude for past consulting payments made to Stronach, but with a premium this large, the eyebrows have been raised.”

“The [pension plans] are sending an unambiguous message to the market that this is unacceptable,” Prof. LeBlanc added.

The battle began brewing on May 6, when Magna International Inc. and the Stronach Trust announced a transaction that would eliminate the upper class of shares, which allow the Stronach family to have voting control despite owning less than 1% equity.

Under the proposal, the Stronach family would get more than 12 subordinate voting shares for each multiple voting share they own. In addition to nine million new shares they will receive, which are now worth more than $650-million, the family will also get a cash payment of US$300-million. If you distill it down to the number of multiple voting shares Mr. Stronach owns, the executive compensation payout amounts to roughly $1,200 a share, one analyst noted.

Investors, for the most part, have plugged their noses and accepted the terms of the deal. The reason: While the price tag on the surface appears high, Magna’s shares have historically traded at a 30% discount to peers primarily because of the dual-voting structure. “Shareholders have waited a long time for a proposal such as this which is also amenable to Mr. Stronach, so some would say this is a one shot deal,” said one analyst who does not wish to be identified.

For years, Canada’s pension plans have been leading a charge to eliminate dual-class share structures. A handful of companies, including MDC Partners, Home Capital Group, Sherritt International and Sceptre Investment Counsel, have converted their dual-share status to a single stock. But in seven of the eight previous deals, there was no premium paid to controlling shareholders for converting their dual shares. Sherritt International’s controlling shareholders received a 66% premium, but even that is small in relation to the 1798% premium the board is offering to pay Magna’s Class B shares, according to Teachers’ calculation.

A 2009 report, released by Toronto-based Osgoode Hall Law School, concluded that between 20%-25% of companies listed on the Toronto Stock Exchange have dual-share structures.

“From an economic development competitive perspective, dual-class shares are not conducive to strong capital markets,” says Poonam Puri, associate professor of Law at Osgoode.

“For that reason, pension funds in Canada play an extremely important role in terms of corporate governance ... and they have a number of tools at their disposal that they are willing to pull out at the right time,” she added. Their response to the Magna proposal “will make Canadian issuers, investors and regulators alike think harder about dual-class share structures,” Ms. Puri said.

At the time of the proposal, CIBC, the financial advisor to the special committee of Magna’s board of directors, did not provide a fairness opinion. In his statement, Mr. Denison “urged the board to develop a proposal to eliminate their dual-class share structure in an equitable way.”

Tracy Fuerst, Magna spokesperson, said the company had no comment on the news.

Friday, June 4, 2010

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment